The Michigan Supreme Court’s recent decision to revive an old law — the Earned Sick Time Act (ESTA) of 2018 — is set to kick off changes to the state’s minimum wage, tipped wages, and paid sick leave on Feb. 21, 2025.

If the changes go forward as planned, nearly all Michigan employers will need to update their paid sick leave policies and ensure compliance with the increases in minimum wage and tipped minimum wage before the effective date in February.

Although there’s a chance elected officials might amend the proposed standards before the law takes effect next year, it’s important all Michigan employers understand and begin preparing to implement these changes now.

If you’re a Michigan employer, here’s what you need to know:

Changes to minimum wage and tip

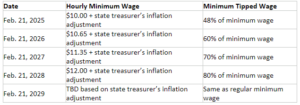

The standards for hourly minimum wage and minimum tip wages will increase according to the following phased schedule:

Changes to paid sick leave

In reviving the ESTA, the Supreme Court’s recent ruling essentially voided the Paid Medical Leave Act (PMLA). (See the How We Got Here section at bottom to understand the legislative back and forth that led Michigan back to the ESTA. the .)

What it Means For You

If you, as an employer, are not presently subject to PMLA, you should plan to implement a sick leave policy in accordance with the ESTA before Feb. 21, 2025. If you are currently following the PMLA, you should review your organization’s policies and plan to revise them to comply with the ESTA before Feb. 2025.

What’s Different, What’s the Same?

Overall, the ESTA is substantially different and more expansive than the PMLA. The key changes to paid sick leave requirements under the ESTA include:

- Coverage: All employers are covered, regardless of size, whereas the PMLA applied only to companies with 50 or more employees.

- Eligibility: All employees are entitled to sick leave, regardless of whether they are part-time, temporary, exempt, or non-exempt.

- Accrual: Employees will accrue one hour of earned sick time for every 30 hours worked, versus one hour for every 35 hours worked under the PMLA.

- Usage: Employees may use up to 72 hours of earned sick time per year, versus 40 hours per year under the PMLA. For large employers (i.e., those with 10 or more employees), all 72 hours must be paid. For employers with less than 10 employees, only 40 hours must be paid.

- Carryover: All earned sick time rolls over to the next year, with no carryover limits, only usage limits.

- Incremental Use: Employees may use leave in the smaller of hourly increments or the smallest increment the employer’s payroll system uses to account for absences or use of other time.

- Waiting Period: Employers can implement a 90-day waiting period for new hires.

- Documentation: Employers may request documentation to substantiate the need for earned sick leave only if the absence is for four or more consecutive days (under PMLA, it was at least three days). Employers must pay any out-of-pocket costs incurred by employees in securing documentation and may not require that documentation explain the nature of the illness or details of violence.

- Notices and Posters: Posters must be updated, and employers must provide a notice of rights to new hires and current employees. Notices and posters must be in English, Spanish, and any other language spoken by 10% of the workforce if the Department of Labor and Economic Opportunity (LEO) has translated the posters and notices into those languages.

Changed: Records & Retaliation

The ESTA provides employees with a private right of action against an employer who interferes with or retaliates because of the use of earned sick time. Employers must retain records for three years, instead of one year under the current PMLA law. Failure to maintain records creates a presumption that the employer violated ESTA. While there are no retaliation provisions under PMLA, ESTA specifically prohibits and defines retaliation and creates a rebuttable presumption of retaliation if an employer takes adverse personnel action against a person within 90 days after that person:

- Files a complaint with LEO or in court alleging an ESTA violation.

- Informs any person about an employer’s alleged ESTA violation.

- Cooperates with LEO or another person in the investigation or prosecution of any alleged ESTA violation.

- Opposes any policy, practice, or act that is prohibited by ESTA.

- Informs any person of their ESTA rights.

Under PMLA, a claimant has up to six months to file a claim with LEO, but this is expanded under ESTA, allowing a statute of limitations of up to three years to file a claim with LEO or file a civil action in court.

Unchanged: Previous Qualifying Reasons

All of the existing qualifying reasons under the current PMLA law still apply:

- Mental or physical illness or injury of the employee or employee’s family member

- Medical diagnosis or treatment of illness or injury of the employee or employee’s family member

- Preventative medical care for the employee or employee’s family member

- Matters arising from the employee or employee’s family member being a victim of domestic violence or sexual assault

- If the employee’s place of business is closed due to a public health emergency

- If the employee’s child’s school or place of care is closed due to a public health emergency and the employee needs to care for the child

- If a public official or healthcare provider determines that the health of others may be jeopardized because of the employee or employee’s family member’s exposure to a communicable disease

Changed: New Qualifying Reasons & Relationships

Newly added under ESTA: Meetings at a child’s school or place of care related to the child’s health or disability, or the effects of domestic violence or sexual assault on the child.

Care for family members that is presently covered under PMLA and still covered under ESTA includes all of these relationships, with more added:

- Child (biological, step, foster, legal ward, in loco parentis)

- Grandchild

- Spouse

- Parent (biological, foster, step, adoptive, legal guardian)

- Grandparent

- Sibling (biological, foster, or adopted)

Plus additional relationships:

- Step-sibling

- Child of domestic partner

- Domestic partner

- Any other individual related by blood or affinity whose close association with the employee is equivalent to a family relationship

PMLA/ESTA Consistencies

- Benefit year is any consecutive 12-month period used by an employer (e.g., calendar year, employment year, etc.)

- 90-day waiting period

- No payout of unused paid sick leave at year-end or termination.

- Employer does not have to count paid time off (vacation, personal, PTO) as hours worked.

- Employer can count other paid time off (e.g., vacation, personal, PTO) toward leave entitlements under the act.

How we got here

In 2018, the Michigan Legislature adopted proposed ballot initiatives that would have required employers to provide generous paid sick leave to employees through the Earned Sick Time Act (ESTA) and scheduled substantial raises to Michigan’s general minimum wage and minimum wage for tipped employees.

This move avoided the need to put the initiatives on the ballot, which would have required a supermajority vote to amend them if enacted through a ballot procedure. After adopting the initiatives, the legislature amended the laws through a simple majority vote, reducing the paid sick leave requirements to what is now known as the Paid Medical Leave Act (PMLA) and amending the minimum wage increases.

On July 31, 2024, the Michigan Supreme Court ruled that the legislature’s “adopt-and-amend” procedure violated the Michigan Constitution. As a result, the court reinstated the original ESTA and minimum wage increases and invalidated the amendments the legislature had made to that law.

The court further held that its ruling would not take immediate effect, allowing employers time to prepare for the Feb. 21, 2025, effective date.

If you have any questions about these laws and their potential effects, please contact your Rehmann advisor. Rehmann will continue to monitor these laws and provide any further updates as news develops.

Disclaimer: The information provided herein is disseminated with the express consent of Warner Norcross & Judd LLP and Honigman LLP. This document contains material sourced from Honigman’s legal alert. Rehmann is authorized to circulate this content and extends gratitude to the firms for their collaboration. The shared material is for informational purposes only and does not constitute original content created by Rehmann.