Updated 09.19.2023: Correction regarding Depreciation Conformity

The original article incorrectly stated Ohio would start following federal rules related to depreciation. Although this change was proposed in various version of HB 33, this provision was not adopted. As such, Ohio continues to decouple from federal bonus depreciation and excess Section 179. We have removed the segment from the below overview, but wanted to notify readers of our original messaging to help avoid any confusion.

Signed into law July 3, and effective July 4, 2023, the Ohio Biennial Budget Bill (HB 33) included a myriad of business and individual tax law changes. Among those changes were several provisions that might impact your Ohio taxes.

Individual Income Tax

Pass-through Entity Tax Credit Expanded: The Ohio Resident credit has been expanded, allowing taxpayers to take into account pass-through entity taxes (PTET) paid to other states—if the amount of state taxes that were deducted for federal tax purposes are added back to Ohio adjusted gross income. Note: The Act includes this addition to income in the definition of business income for the purposes of the Ohio Business Income Deduction. The provision applies to tax years beginning Jan. 1, 2023, but it can be retroactively applied to either an originally filed or amended 2022 Ohio individual tax return.

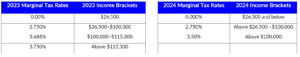

Income Tax Rate Reduction: Over the next two years, Ohio will phase in reductions of income tax rates, consolidating individual tax brackets from four to three.

Commercial Activity Tax (CAT)

CAT Exclusion Increased: Beginning tax year 2024, the first $3 million of gross receipts will be exempt from the CAT. In tax year 2025, CAT Exclusion will increase to $6 million of gross receipts. The tax rate above both thresholds will remain the same: 0.26%. This change does not relieve a filing requirement for those subject to the tax.

Municipal Income Tax

Exemptions: For tax years starting on or after January 1, 2024, individuals under 18 years old are exempt from municipal income taxation.

Net Profit Apportionment: Beginning in tax years ended after 2023, businesses with remote or hybrid employees or owners will now have the ability to use a modified apportionment formula. This optional change allows businesses to apportion any remote-worker-attributable property, payroll, or gross receipts to a designated location owned or controlled by either the business or one of its customers. It is important to note that this only applies to net profits tax; not withholding tax.

Extension for Entities: Starting in tax year 2023, businesses receiving a six-month federal income tax extension will now have an additional month (i.e., seven months from the original due date) to file their net profits tax returns.

Additional changes prompted by Ohio HB 33 can be found here.

Want to learn more about how these changes could impact you? Please contact your Rehmann advisor with any questions or concerns.